Spain Introduces New Bank Tax: What Expats Need to Know

In a significant move to bolster the country's finances and address economic challenges, Spain has announced the implementation of a new tax on banks, a measure that is set to have far-reaching implications for the financial sector and potentially for consumers.

Background and Rationale

The Spanish government, led by Prime Minister Pedro Sánchez, has been navigating a complex economic landscape, including the aftermath of the COVID-19 pandemic and the ongoing global economic uncertainties. The new bank tax is part of a broader strategy to increase revenue and support public finances.

Key Details of the Bank Tax

- Effective Date: The tax is scheduled to come into effect in the coming months, although the exact date has not been finalized.

- Tax Rate: The tax rate is expected to be around 4.8% on the net profits of banks, a figure that could generate significant revenue for the government.

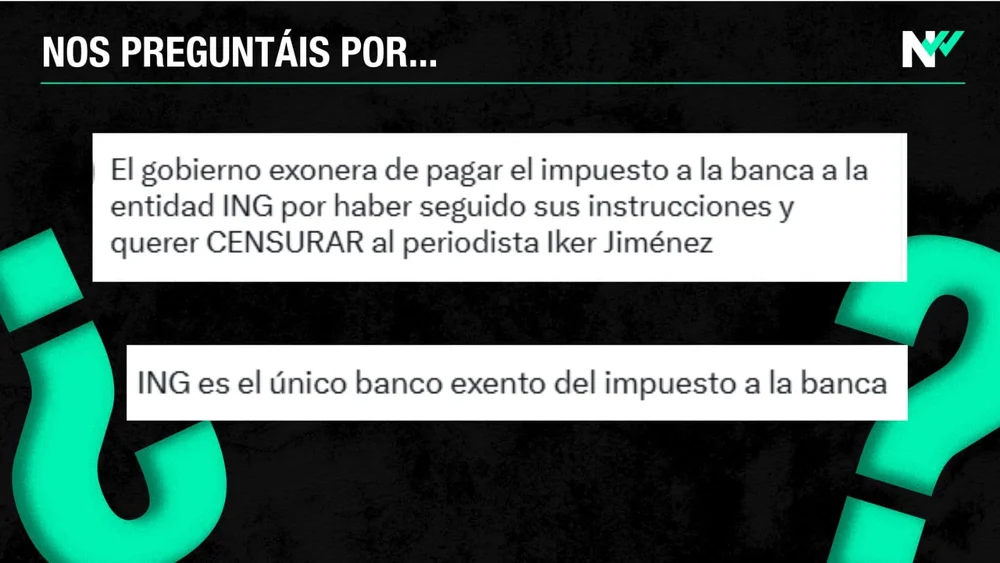

- Scope: The tax will apply to all banks operating in Spain, including both domestic and international institutions.

- Revenue Projections: The government anticipates that this tax will generate substantial revenue, which will be used to support various public programs and reduce the national debt.

Impact on Banks and Consumers

The introduction of this tax could have several consequences for both banks and their customers. Here are some key points to consider:

- Increased Costs for Banks: Banks will need to absorb the additional tax burden, which could lead to higher operating costs. This might result in banks passing these costs on to consumers through higher fees or interest rates.

- Potential Impact on Lending: The increased costs could also affect the lending practices of banks. In a loosening cycle, where interest rates are being reduced to stimulate borrowing, the additional tax burden might slow down the transmission of these benefits to consumers[2].

- Consumer Implications: Expats and residents alike might see changes in banking services, including potential increases in fees for various banking products. However, the competitive nature of the Spanish banking sector, as highlighted by recent studies, suggests that banks may strive to maintain customer satisfaction despite these challenges[4].

Economic Context

Spain's banking sector has been through significant transformations in recent years. The sector has shown resilience, particularly in the face of monetary policy changes. For instance, during the recent loosening cycle, Spanish banks have been quick to translate reduced official interest rates into lower lending rates, benefiting borrowers[2].

Conclusion

The new bank tax in Spain is a strategic move aimed at strengthening the country's financial stability. While it may introduce new challenges for banks and potentially affect consumers, the Spanish banking sector's adaptability and competitiveness are likely to play crucial roles in mitigating these impacts. As the details of the tax become clearer, expats and residents will need to stay informed about how these changes might affect their banking services and overall financial situation.

Related Stories

Spain Resets VAT on Staple Foods as Economic Measures Evolve

Spain to reset VAT on staple foods to pre-crisis levels in 2025, extending public transport subsidies and maintaining economic support measures.

Spanish Stock Market Closes 2024 on a High Note Despite Global Uncertainty

Despite global uncertainties, the Spanish stock market's IBEX 35 index soared, marking a year of impressive growth and resilience in 2024.

Spanish Tax Authority Initiates Refund Process for 2023 Tax Returns

The Spanish Tax Authority has launched the refund process for 2023 tax returns, with key dates from April 3 to July 1, 2024, offering crucial information for expats.

New Initiative to Boost Local Economy in Comillas, Cantabria

Comillas launches "Comillas Vale" initiative with 800 vouchers to boost local economy and community engagement, starting January 15, 2025.

Torrelavega Emerges as a Key Hub for Commerce and Industry in Cantabria

Torrelavega cements its role as Cantabria's industrial and commercial hub, with strategic investments and natural resources driving economic growth.